IBM aka International Business Machines Corporation is a giant in the technology industry. It is necessary to keep an eye on IBM stock If you’re an investor or trader. Fintechzoom is one of the most popular platforms for tracking stock information. It offers detailed analysis and updates to help you stay informed. So, why should you track IBM stock on Fintechzoom? And how can this platform aid your investment decisions? Read about FintechZoom IBM stock, performance, and how the platform can enhance your trading experience.

Contents

Understanding IBM Corporation and Stock

IBM stock represents ownership in IBM Corporation. A popular publicly traded company on the New York Stock Exchange under the ticker symbol “IBM”. This stock gives shareholders a share in the company’s profits. Investors benefit through dividends and potential stock price appreciation.

IBM has a long-standing reputation as a leading technology company. Founded in 1911, IBM started as a computing and tabulating company. Over the years, it evolved into a leader in technology solutions, including hardware, software, and IT services.

IBM has traditionally been a conservative but reliable choice. It offers steady dividends and capital appreciation. The company’s stock has transformed over time due to shifts in technology trends and business focus. This makes it an interesting option for both growth and income-focused investors.

Performance of IBM Stock on FintechZoom

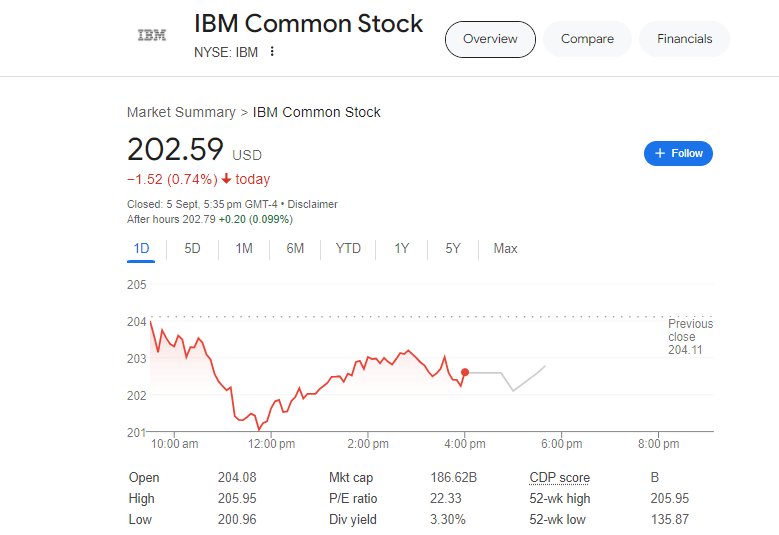

IBM went public in 1916. Since then, its stock has seen unconditional growth with major spikes during the tech boom of the 1980s and 1990s. In the past decade, IBM’s stock has faced challenges as it shifted focus to cloud computing and AI. Recently, IBM’s stock has stabilized after a period of fluctuation. Investors are now concentrating on the company’s growth in cloud and AI segments. These areas are projected to drive future earnings.

The company has a long history of paying dividends and is often classified as a “dividend aristocrat.” This means it has increased its dividend for over 25 consecutive years. With a current yield of around 4-5%, IBM provides a reliable income stream, especially during market volatility. Compared to other tech giants like Google and Amazon, IBM offers a significantly higher dividend yield. This makes it a reliable option for income-focused investors.

Related Post: Money Fintechzoom: A Guide to Premium Luxury Fintech

Chart of Fintechzoom IBM Stock Forecast and Price

2000-2010: The Transition to Software and Services

- IBM shifted its core business from hardware to focus more on software and services. This strategic move helped IBM capitalize on the growing demand for IT services.

- During this decade, IBM’s stock price rose steadily, from around $100 per share in 2000 to $130-140 per share by 2010. The company also sold non-core assets, like its personal computer division to Lenovo to further streamline operations.

2010-2015: Cloud Computing Initiatives

- In this period, the company made a strong push into cloud computing and other high-tech services. This helped it stay competitive but the stock price fluctuated between $150 and $190.

- While cloud initiatives showed promise, IBM was slow to catch up with competitors and raised concerns about its market position. They invested in cloud infrastructure, analytics, and data, setting the stage for future growth despite these challenges.

2015-2020: The Red Hat Acquisition and Growth in AI

- A major highlight was IBM’s acquisition of Red Hat in 2018 for $34 billion. This move aimed to strengthen IBM’s position in the hybrid cloud market. The acquisition sparked optimism among investors, although IBM’s stock price remained relatively stable between $120 and $150.

- IBM also increased investments in AI and cognitive computing, particularly with its Watson AI platform. However, revenue growth remained modest.

2020-2023: IBM’s Focus on AI and Hybrid Cloud

- IBM’s cloud and AI services became even more relevant during the COVID-19 pandemic. The stock price ranged between $110 and $140 during this time, as investors watched IBM’s execution of its hybrid cloud strategy.

- By 2024, IBM showed signs of renewed growth, especially in cloud, AI, and business automation services. This led to slight stock appreciation in response to improving revenues in these areas. Now the current price is $202 per stock.

How To Buy IBM Stock on Fintechzoom?

Buying IBM stock using the FintechZoom platform is straightforward and convenient. Here’s a step-by-step guide:

- Visit FintechZoom and Search for IBM Stock

Start by going to FintechZoom.com and using the search bar to look for “IBM” or simply enter its ticker symbol “IBM.” This will take you to a detailed page about IBM stock, where you can view its current price, performance metrics, and financial news. - Review Stock Analysis and Forecasts

Before purchasing, take advantage of the various analysis tools available on FintechZoom. Review the stock forecasts, dividend history, and other key metrics to ensure that IBM fits your investment strategy. You’ll also find expert opinions and earnings reports that can help you decide whether now is the right time to buy. - Click on “Buy IBM Stock” Button

FintechZoom partners with various brokerage platforms like eToro or Robinhood. On the IBM stock page, there’s usually a “Buy IBM Stock” button that will redirect you to one of these trusted platforms where you can purchase the stock. - Set Up a Brokerage Account

If you don’t already have a brokerage account, FintechZoom provides links to set up an account with its partner services. You’ll need to provide some basic personal information and financial details to complete the registration process. - Place Your Order

Once your account is set up, you can search for IBM stock and place a purchase order. You have the option to buy at the current market price or set a limit order to buy when the stock reaches a specific price. Make sure to review the order before confirming.

Related Post: FintechZoom Tesla Stock: Guide to Comprehensive Analysis

Risk Analysis on IBM Stock Investment

Investing always comes with risks and here are the major risks involved:

1. Slow Growth in Traditional Businesses

IBM’s traditional hardware and IT services are in decline. The company is shifting towards cloud computing and AI, but the transition has been slow. There’s a risk that the legacy business may hinder overall growth.

2. Intense Competition in Cloud and AI Markets

IBM faces strong competition from giants like Microsoft (Azure), Amazon (AWS), and Google Cloud. This pressure could limit IBM’s market share growth, especially in hybrid cloud and AI sectors.

3. Execution Risks in Transformation Strategy

IBM’s shift to a cloud-based, AI-driven model involves significant investments and complex changes. There’s always a risk that the company might struggle with its strategic goals, leading to slower-than-expected results.

4. Economic and Geopolitical Factors

Global economic conditions, including inflation and recession fears, can impact IBM’s operations. Geopolitical issues like trade restrictions or conflicts may also disrupt IBM’s global business, especially in high-growth regions.

5. High Dependency on Acquisitions for Growth

IBM relies heavily on acquisitions, like the Red Hat deal, to drive growth in cloud and AI. While these acquisitions open new revenue streams, they also come with integration risks. The expected synergies and growth might not always materialize, affecting IBM’s stock performance.

Comparing IBM Stock with Competitors

IBM competes with major tech giants in the cloud computing space, such as Microsoft (Azure), Amazon (AWS), and Google Cloud. Each of these companies has a strong presence in the cloud market, which challenges IBM’s position. However, IBM’s focus on hybrid cloud—a blend of on-premises and cloud-based services—provides a unique advantage. This approach allows businesses flexibility and control over their data which sets IBM apart.

- IBM vs. Microsoft

IBM and Microsoft are both strong contenders in cloud computing. However, Microsoft holds a larger market share which makes it more dominant.

- IBM vs. Google

IBM’s cloud services differ from Google Cloud’s offerings. Both companies compete to attract business clients with their cloud solutions.

- IBM vs. Amazon

Amazon leads in cloud services through AWS. IBM’s hybrid cloud model offers a different approach, but it lags behind Amazon in market share and revenue.

Expert Opinions on this Stock

As of 2024, analysts have mixed opinions on IBM. Some believe the company’s efforts in AI and quantum computing will drive long-term growth. Others are cautious about its ability to compete with larger cloud providers. For current IBM stockholders, it’s a matter of balancing long-term potential with the risks of slower growth. Many analysts recommend holding, but the decision depends on your investment goals.

Tips for New Investors

- Understand market trends before investing in IBM, especially in cloud computing and AI. These trends will likely influence IBM’s future growth.

- Like any stock, IBM comes with risks, including competition from larger tech companies and the challenges of staying relevant in a rapidly evolving industry.

- IBM is better suited for long-term investors looking for steady dividends and future growth in emerging technologies.

Wrapping Up

IBM remains a significant player in the tech industry. The company’s future growth is driven by cloud computing, AI, and quantum computing. Tracking IBM stock on Fintechzoom helps investors stay informed and make smart decisions. IBM offers a balanced mix of dividends, long-term potential, and innovation for new and seasoned traders.